It’s October – have you completed your 2016 Budget yet?

Guest blog from Brian Hoppe, vCFO and Senior Consultant, MANAGEtoWIN

It is hard to believe this is October already. Time flies. My guess is most of you have not started a budget for 2016, much less completed it.

Avoid repeating this mistake. Join me and David Russell as I explain the WHY – WHAT – HOW of budgeting for IT service organizations. I have been a service manager and CFO of a highly profitable MSP. Let me help you.

Click here to register. Space is limited.

If you have thought about budgeting, you might not have any idea where to start. Let’s change that. Today you can learn WHY you must have a budget to grow profitably, WHAT life looks like with a budget, and HOW to create one for your business.

Why a budget?

Most of us equate budgeting with personal finance and restrictions on spending and therefore we hate it. Do not get stuck in this way of thinking!

In reality, a budget creates FREEDOM. Freedom to plan, freedom to strategize, and freedom for your company to perform its best!

When you have a budget in place, it provides you:

- A target at which to shoot, not only for revenue, but for Gross Margin, profitability, and performance for your people.

- Understanding of what you need to do to achieve your goals.

- Clarity as to where your people need accountability.

- Ability to plan for resource needs into the future.

According to Service Leadership, having a budget and tracking your performance-to-budget on at least a monthly basis is a key indicator of maturity and profitability for all IT solution provider businesses. Not only that, but incentivizing your management team heavily on achievement of budget will increase your chances of success.

Start by Building the Model

Now that we know budgeting is a good idea, how do you go about it? The answer: It is a simple process, but not easy! A good way to start is by building a budget model for your business – start at the top with the major categories and work your way down.

Here are the six different major categories you need to budget:

- Revenue

- COGS

- GM

- Expenses

- EBITDA

- Net Income

There are many ways to build a great budget model. There are also plenty of different systems you can use, and your accounting software likely has a module built in for budgeting. For simplicity’s sake, I recommend you exporting your P&L by Month to Excel and work from there.

NOTE: Make certain your Chart of Accounts is setup appropriately for this exercise. To read more about this, google “Normalized Solution Provider Chart of Accounts” and you’ll find plenty of helpful tips.

Budget Your Revenue

Define a reasonable estimate of your revenue for each revenue category monthly and annual total. For instance, if your Managed Services revenue has been $20,000 per month, how much are you going to grow that each month in 2016? You might say we can reasonably grow it $1,500/month each month next year. This means January managed services recurring revenue increases to $21,500; February to $23,000, and so on. Will that happen every month? Make a reasonable assumption based on your level of activity, expectations of your team, and historical data.

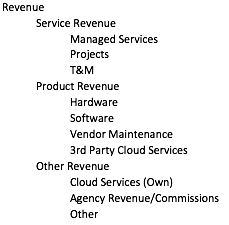

When done correctly, your Revenue lines might look something like this:

Once you have your revenue budgeted, you are ready to budget your Cost of Goods Sold.

Cost of Goods Sold

Put every cost associated with delivering the revenue for each particular line of business in Cost of Goods Sold. You will probably have multiple COGS lines for each revenue line. For instance, Managed Services has costs for the tools you use (such as PSA and RMM), costs for people (including salaries, taxes, insurance, etc…), and possibly travel or other items. All costs to deliver revenue must be included to most accurately gauge your profitability!

Enter these costs into the appropriate columns and you are ready to calculate your budgeted Gross Margin.

Gross Margin

Follow these steps to calculate your Gross Margin:

- Take the revenue line and subtract the sum of the COGS line for that revenue line. This determines your Gross Margin dollars for that Line of Business.

- Let’s also go one step further to calculate our GM percentage by dividing the GM dollars by Revenue dollars. This determines your budgeted GM percentage. Ideally, this number should be north of 50% on services and over 15% on product.

- Repeat steps 1 and 2 for each revenue/COGS line. Total them at the bottom to find your total Gross Margin.

Are you hitting the right Gross Margin numbers for your business? If you are not hitting those numbers, what do you need to change in your cost structures to improve on them and increase your profits? You may be pricing your products and services too low, or perhaps you are paying your people too much. Performing these calculations provides insight into your business and allows you to make the right adjustments.

Expenses

Next, budget expenses. You have a history for all your expenses, and expenses “below the line” of Gross Margin should not change much on a monthly basis. These include your administrative salaries, building costs, Sales & Marketing, and other expenses. When budgeted appropriately, you should understand the amount of your “nut,” or total costs per month (exclusive of the items that are required to deliver services). Budgeting all your expenses significantly improves your ability to correctly comprehend the total Gross Margin dollars you need each month to cover those expenses, and therefore make money!

EBITDA

Simple math: You make money when you spend less in expenses than you earn as Gross Margin dollars. Congratulations! Many of your peers are unable to achieve this!

EBITDA refers to Earnings Before Interest, Taxes, Depreciation, and Amortization. To calculate this, simply subtract your Expenses from your total Gross Margin. It is one way to define profit targets, but not the only way.

Net Income

The final calculation we perform is Net Income. Calculate the Interest, Taxes, Depreciation, and Amortization on your earnings (EBITDA) and subtract it from your earnings to get our Net Income number. Again, for 2016 these numbers are estimated based on what they have been in the past and how you project they will change based on your company’s growth in 2016 (and beyond).

Done! Well, at least the numbers part is… Net Income is your final number, no more calculations. I sincerely hope it is positive. If not, you need to take a hard look at your business and decide where to make some changes.

This leads me to my final point: A budget is worthless if you refuse to hold your Company accountable to achieving it. Positive, inspiring accountability drives every successful organization that has a wisely defined budget.

Do not delay budgeting. Take this as your chance to do something different for next year to bridge you to new territories of profitable growth. Our goal is to help educate and mentor leaders to develop new habits and implement better systems that positively impact your business now and for years to come. If you need help, email me!

And DO NOT MISS my webinar explaining the WHY – WHAT – HOW of budgeting for IT service organizations. Click here to register. Space is limited.